CaR Insurance

At LoPriore Insurance Agency, we get that you want affordable coverage that’s perfect for your needs. With our long history of helping folks like you, we’ve mastered the art of finding the best car insurance discounts and coverages out there.

No more cookie-cutter plans! Snag your customized auto insurance quote in a flash and make sure you’re only paying for the stuff that truly matters on your road adventures.

Options Below

Massachusetts Car Insurance

Quote Options

For an online auto insurance quote, simply complete the form below. We will contact you to discuss coverage options and discounts.

Current Policy

Already have a policy? Easily upload your insurance policy so we can explore and compare true apple-to-apple options.

Agent

Need assistance or have questions? Our agents are happy to help. Please call to discuss your insurance needs.

Instant Online Car Insurance Quote

For an online auto insurance quote, simply complete the form below. We will contact you to discuss coverage options and discounts.

Upload Your

Current Policy

Already have a policy? Easily upload your insurance policy so we can explore and compare true apple-to-apple options.

Talk To An

Agent

Massachusetts Car Insurance

Lopriore Insurance Agency

At LoPriore Insurance, We Make Insurance Easy For You. We understand that your car is more than just a mode of transportation. It’s a valuable asset that provides convenience, freedom, and peace of mind. That’s why we are dedicated to working with you to offer the best auto insurance policy that suits your unique needs and budget.

Trust LoPriore Insurance to provide you with personalized attention, expert advice, and comprehensive coverage options, making auto insurance hassle-free. One stop-shopping with our network of trusted local, national, and regional insurance companies, we can offer top rates and insurance coverage at the best insurance prices.

Vehicles We Insure

Car Insurance

Classic Car Insurance

Motorcycle Insurance

Recreational Vehicle Insurance

Business Auto Insurance

Vehicles We Insure

Car Insurance

Classic Car

Insurance

Motorcycle

Insurance

Recreational Vehicles Insurance

Understanding the Importance of

Car Insurance

Car insurance provides coverage for unexpected incidents that occur while operating a motor vehicle. Accidents cause damage to vehicles, injuries to individuals involved, and other property damage. Personal auto insurance provides restitution for these damages and injuries.

Auto insurance is required for all Massachusetts drivers. If you own and operate a vehicle here, you’re required to purchase a minimum amount of liability insurance. If you have a car loan, your lender will require you to carry additional collision and comprehensive policies to ensure they’ll recoup the loss if the vehicle is damaged before it’s paid for.

Any person who wants to operate a registered vehicle in Massachusetts must purchase the required minimum auto insurance coverage as directed by the Division of Insurance guidelines. Drivers with a car loan must also have additional insurance policies. Anyone who wants the peace of mind obtained with the protection against damage and liability provided by car insurance can benefit from an auto insurance policy.

How To Insure My PERSONAL Vehicle

Getting personal car insurance begins with assessing your individual needs and determining the appropriate level of coverage required for your vehicle. If you have a loan or lease on your car, ensure the coverage meets the lender’s requirements. Consider your budget to find a policy with affordable and regular premium payments. As a responsible driver, you understand the importance of safety, but accidents can still happen. Properly protecting yourself and your vehicle from potential risks is crucial. If navigating through the various coverage options seems overwhelming, our team is here to assist you every step of the way, simplifying the decision-making process and ensuring you have the right personal auto insurance to keep you well-protected on the road.

Tips for buying Car Insurance

When purchasing Commercial Auto Insurance, it’s crucial to make informed decisions to ensure your business vehicles and operations are adequately protected. Here are some essential tips to consider:

Who Needs To Be Listed On An Car Insurance Policy

When applying for car insurance in Massachusetts, ensure you list all individuals who regularly have access to your vehicle, as this is usually a standard requirement. This includes anyone who may drive the car regularly or occasionally, as accurate disclosure helps ensure appropriate coverage and compliance with insurance regulations.

It’s essential to provide your insurance company with complete and accurate information about all drivers of your vehicle. Failing to do so could lead to denied claims or even policy cancellation.

Always remember that insurance regulations can vary by state and individual insurance policies can have different requirements. Therefore, it’s a good idea to have a chat with your insurance agent or representative to make sure you’re covering everyone who needs to be listed on your policy.

Looking To Save More

Bundle Your

Car and Home

Looking to save more on your insurance costs? Bundle your home and car insurance today and discover the great discounts and benefits that come with combined coverage. Act now and start saving!

Cost of Car Insurance

in Massachusetts

In Massachusetts, the cost of a full-coverage car insurance policy can vary significantly based on a multitude of factors. While the average annual premium is around $1,730, individual rates can be higher or lower depending on several key considerations. The type and level of coverage chosen play a vital role, with full coverage typically including liability, collision, comprehensive, and other optional coverages. Each component contributes to the overall premium, allowing policyholders to customize their policy to meet their specific needs and risk tolerance.

To manage auto insurance costs effectively, Massachusetts drivers should explore available discounts. Safe driver discounts, bundling multiple insurance policies with the same provider, and utilizing discounts for low-mileage or hybrid vehicles can help reduce premiums. Comparing quotes from various insurance providers allows individuals to find the most competitive rates and tailored coverage that meets their specific needs and budget. Working with an insurance professional can provide valuable insights and guidance in navigating the complexities of auto insurance in Massachusetts and securing the best coverage at a reasonable cost.

Insurance

Cost of Insurance Breakdown by City

Avg Annual Cost $1,875

Avg Annual Cost $2,596

Avg Annual Cost $2,882

Avg Annual Cost $2,771

Avg Annual Cost $2,714

Avg Annual Cost $2,477

Avg Annual Cost $1,314

Avg Annual Cost $1,410

Avg Annual Cost $1,389

Avg Annual Cost $1,799

Avg Annual Cost $1,875

Avg Annual Cost $2,596

Avg Annual Cost $2,882

Avg Annual Cost $2,771

Avg Annual Cost $2,700

Avg Annual Cost $2,477

Avg Annual Cost $1,314

Avg Annual Cost $1,410

Avg Annual Cost $1,389

Avg Annual Cost $1,799

Knowing the average cost of car insurance per city can be essential in making informed decisions about where to live, especially if insurance rates are a significant consideration. While it should not be the sole factor in choosing a location, being aware of these rates can help you plan your budget and expenses accordingly.

LoPriore Insurance Agency can assist in finding the most affordable and suitable car insurance coverage for your needs in Massachusetts. With their expertise, you can explore various options and select the best policy that provides the right level of protection while managing costs effectively. By understanding the average insurance costs in different cities and working with a trusted insurance agency, you can ensure you have the right coverage at competitive rates, providing you with peace of mind on the road.

Cost of Insurance Breakdown by City

Avg Annual Cost $2,596

Avg Annual Cost $2,882

Avg Annual Cost $1,779

Avg Annual Cost $1,389

Avg Annual Cost $2,771

Knowing the average cost of auto insurance per city can be essential in making informed decisions about where to live, especially if insurance rates are a significant consideration. While it should not be the sole factor in choosing a location, being aware of these rates can help you plan your budget and expenses accordingly.

LoPriore Insurance Agency can assist in finding the most affordable and suitable auto insurance coverage for your needs in Massachusetts. With their expertise, you can explore various options and select the best policy that provides the right level of protection while managing costs effectively. By understanding the average insurance costs in different cities and working with a trusted insurance agency, you can ensure you have the right coverage at competitive rates, providing you with peace of mind on the road.

Factors that Affect The Cost Of Car Insurance

The cost of car insurance is influenced by multiple factors that help insurers assess the level of risk associated with a policyholder. A person’s driving record plays a crucial role, with a history of accidents and violations leading to higher premiums, while a clean record often results in lower rates. Additionally, age, gender, vehicle type, location, coverage choices, and credit history are among the key considerations that can impact the cost of personal auto insurance.

And Limits

Click on Item

Already Have Insurance Upload Your Policy

Switching Your Insurance Made Easy!

Upload Your Current Insurance Policy to Compare & Save!

What’s The Advantage of Comparing My Insurance Policy?

When you send us a copy of your policy, our team has an opportunity to get a snapshot of your current insurance coverage, discounts, and added riders on your existing insurance policy.

Where Do I Find a Copy of My Insurance Policy?

Insurance companies send you a copy of your insurance policy annually and if any changes to your policy have been made during the year. However, if you are unable to locate your policy, your insurance company or insurance agent should be able to send you a duplicate copy via email, fax, or mail.

What Happens When You Upload Your Policy?

Once we receive your uploaded policy one of our team members begins reviewing your policy. We will then contact you to discuss your coverage options. Every insurance company has different underwriting guidelines and offers different coverages and rates. Be advised while we try our best to quote with the information provided it still may be necessary to obtain additional information from you to prepare the most accurate rate.

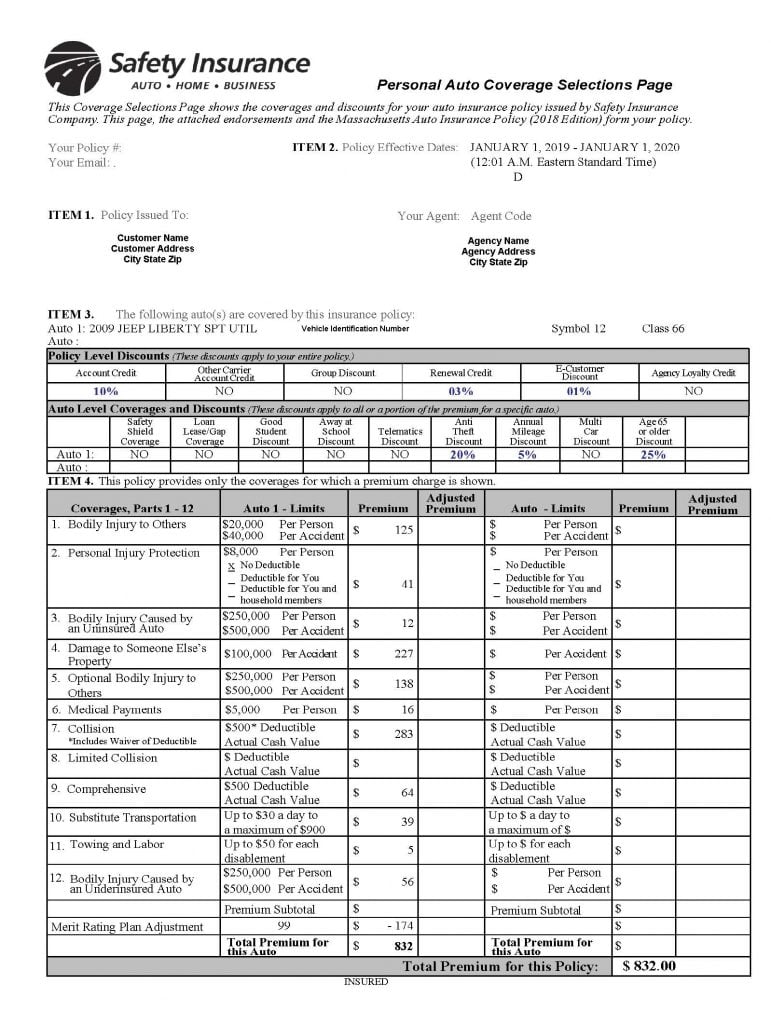

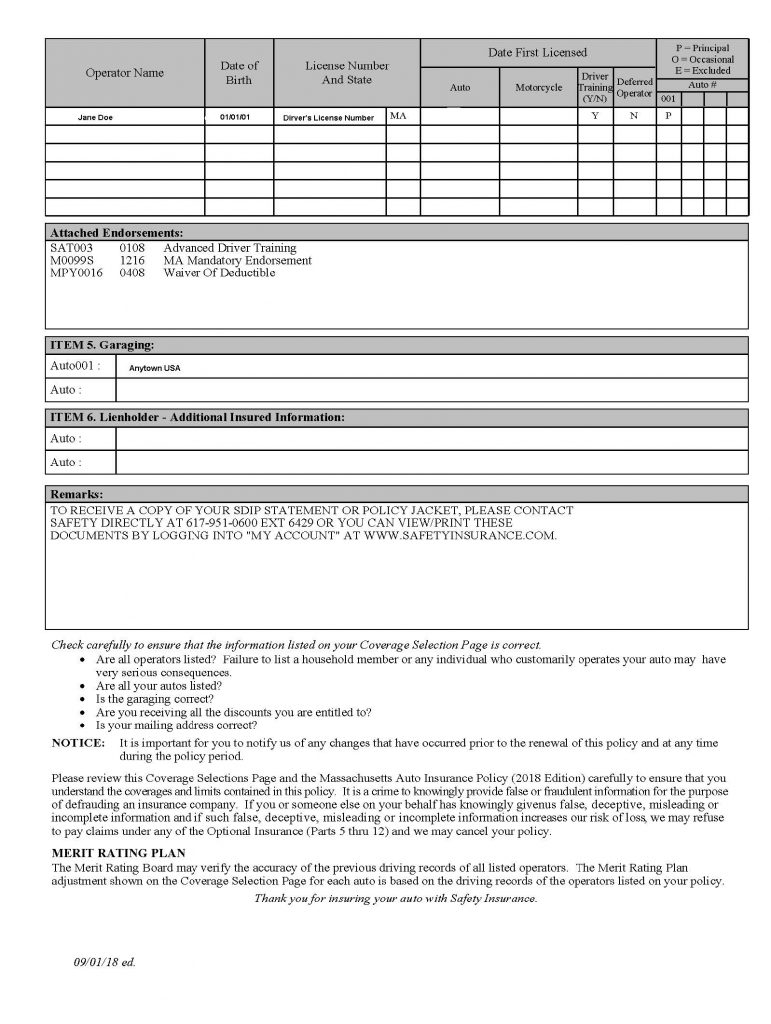

What Does My Insurance Policy Coverage Page Look Like?

Insurance Policies will sometimes be referred to as a Coverage Selections Page or Coverage Declarations Page. Below are samples of the different types of insurance policies (click to see larger view)

Basic Guide

To Car Insurance

Discovering the Key Components and Coverage Options

Car insurance policies typically consist of several parts or components that outline coverage, conditions, and exclusions.

Here are 12 common parts or sections found in an auto insurance policy

Massachusetts Compulsory Auto Insurance Required Coverages

Optional Auto Insurance Coverages

Optional coverage provides additional protection beyond the compulsory requirements. You may wish to extend your auto insurance limits for additional protection or meet your car loan requirements. These are some optional policies we provide.

Car Insurance FAQs

Your auto insurance premium affects individual risk factors. For example, the type of vehicle you have, your driving record, where you live, and other rating factors need to be approved by the insurance commissioner. Discounts, your optional coverage, and the amount of your deductible also factor in.

LoPriore can find you coverage with many discounts to help you get more affordable insurance, including:

- Good driver discount

- Anti-theft discount

- Multi-car discount

- Low mileage

- Paid in full discount

- Student away from home

- Account bundling

- And many more!

A standard auto insurance policy doesn’t cover these programs. However, you can purchase options that include this coverage.

Teens can get a learner’s permit at 16 in Massachusetts. This is a great time to talk to your independent insurance agent and learn more about whether you should add him/her as an existing driver on your existing policy.

Massachusetts car insurance premiums

Your car insurance premiums refer to the amount you pay on a regular basis, typically monthly, bi-annually, or annually, to get the coverage in your policy. It works similarly to premiums for other types of insurance, such as health and life insurance. As such, the costs can vary significantly based on a number of factors.

Navigating the Road to Getting Auto Insurance

LoPriore Insurance is an independent insurance agency providing a wide variety of coverage options for your vehicle. We proudly represent multiple insurance companies, eliminating the need to shop around.

When you apply for a policy, insurance companies will assess the “risk” involved in insuring you. Some factors, such as your personal information like age or address, are beyond your control. However, other factors, such as your driving history and credit history, are within your influence. Having a good credit history is a strong indicator that you are responsible for your payments while having a good driving record shows that you are careful behind the wheel. Thus, these two can lead to lower premiums.

Drivers Affect Your Auto Policy?

Car insurance also allows you to include other drivers in your policy, so the more people you include in yours, the higher the premiums you will have to pay. If you often lend your car to a relative or friend, it would be a good idea to add them to your policy, since you never know what may happen while someone else is driving your vehicle.

Exploring the Price and Discounts in Auto Insurance

Want to get the cheapest possible car insurance in Massachusetts, but still want to make sure you get a sufficient policy? Here at LoPriore, we can help you shop for car insurance rates from several providers, so you can learn about what each company has to offer. We partner with many insurance companies, each with their unique policies and offers, to ensure that we can serve all our clients’ insurance needs.

Auto Insurance Cost?

Rates can range from one insurance provider to another, but the average cost is at about $750 per year for minimum coverage. As for the full coverage policy, the average is approximately $1,475 per year. Naturally, minimum policies have a much lower price than a full policy cost, but the trade-off is that you get less coverage.

Insurance costs can be different for each person as it ultimately depends on the extent of coverage you intend to get, as well as your overall case. Rest assured, our independent agents can connect you to various insurance companies, so you can explore your options and find a policy that suits you best.

On Your Insurance Policy?

Insurance companies also tend to offer discounts, so you can ask our agents for more information on that matter to get a cheaper rate. For example, some providers may give you a bulk discount if you get your homeowner’s insurance and auto insurance from them, while others may offer a discount if you pay your bi-annual or annual premium in one go.

You can also consider raising your deductible, as this results in a lower premium. Liability insurance will usually not require a deductible, but you will need one if you are getting collision or comprehensive coverage. That said, be careful not to raise your deductible too high as it might be beyond what you can afford if an accident happens.

Auto Insurance Cost?

Rates can range from one insurance provider to another, but the average cost is at about $750 per year for minimum coverage. As for the full coverage policy, the average is approximately $1,475 per year. Naturally, minimum policies have a much lower price than a full policy cost, but the trade-off is that you get less coverage.

Insurance costs can be different for each person as it ultimately depends on the extent of coverage you intend to get, as well as your overall case. Rest assured, our independent agents can connect you to various insurance companies, so you can explore your options and find a policy that suits you best.

On Your Insurance Policy?

Insurance companies also tend to offer discounts, so you can ask our agents for more information on that matter to get a cheaper rate. For example, some providers may give you a bulk discount if you get your homeowner’s insurance and auto insurance from them, while others may offer a discount if you pay your bi-annual or annual premium in one go.

You can also consider raising your deductible, as this results in a lower premium. Liability insurance will usually not require a deductible, but you will need one if you are getting collision or comprehensive coverage. That said, be careful not to raise your deductible too high as it might be beyond what you can afford if an accident happens.

Rev Up for Big Savings:

Anticipate Unbeatable

Auto Insurance Discounts!

Prepare for substantial savings on your auto insurance premiums. Embrace the anticipation of unbeatable discounts that will leave you thrilled and your wallet happy.

Rev Up for Big Savings:

Anticipate Unbeatable

Auto Insurance Discounts!

Prepare for substantial savings on your auto insurance premiums. Embrace the anticipation of unbeatable discounts that will leave you thrilled and your wallet happy.

Ready to Get Started?

Get Top Rated Insurance Coverage at the Best Price!

CALL US TODAY