Insurance

Binder

Request

Request

When purchasing a new car or home, it’s common for a finance company to request immediate proof of insurance. When you don’t have time to wait for a new policy, you need an insurance binder to provide proof of your coverage.

When And Why You Need An

Insurance Binder

Need A Binder Fast?

Don’t have insurance?

Need Coverage Fast?

Contact Us Today!

The most common use for an insurance binder is during purchasing a home or auto loan. If you’re refinancing an existing loan, you may also need proof of insurance. Your lender (bank, finance, or lease company) will need you to purchase an insurance policy to protect their investment. Therefore, proof of insurance in the form of an insurance binder is usually a requirement. Here are a few reasons individuals commonly need one:

- Completion of Auto Loan

- Completion of Home Loan (A Mortgage Agreement)

- During the Process of Refinancing An Existing Loan

- Immediately After Purchasing A New Insurance Policy

Insurance Binder

Explained

- Insurance agency and type of coverage

- Identity of who is insured

- Specific information about your automobile or the location of your property

- Deductibles

- Terms of insurance and risks covered

- Liability amounts

- Effective dates of coverage

How To Obtain A

Massachusetts

Insurance Binder

Getting The Insurance

You Need To Close

Your Mortgage Or

Auto Loan

Insurance Binder Request Form

Purchase the Auto Insurance or Homeowners Policy You Need to Buy Your New Home or Car

LoPriore is an independent insurance agency which means we have the opportunity to work with a variety of insurance companies to offer you with the best products at affordable prices. If you’re seeking insurance coverage for your home or vehicle, talk to one of our experienced agents about the coverage you need to fit your lifestyle. We can provide you with a quick turnaround to get dependable coverage and close your loan and get into your dream home or automobile.

Frequently Asked Questions About A

Massachusetts Insurance Binder

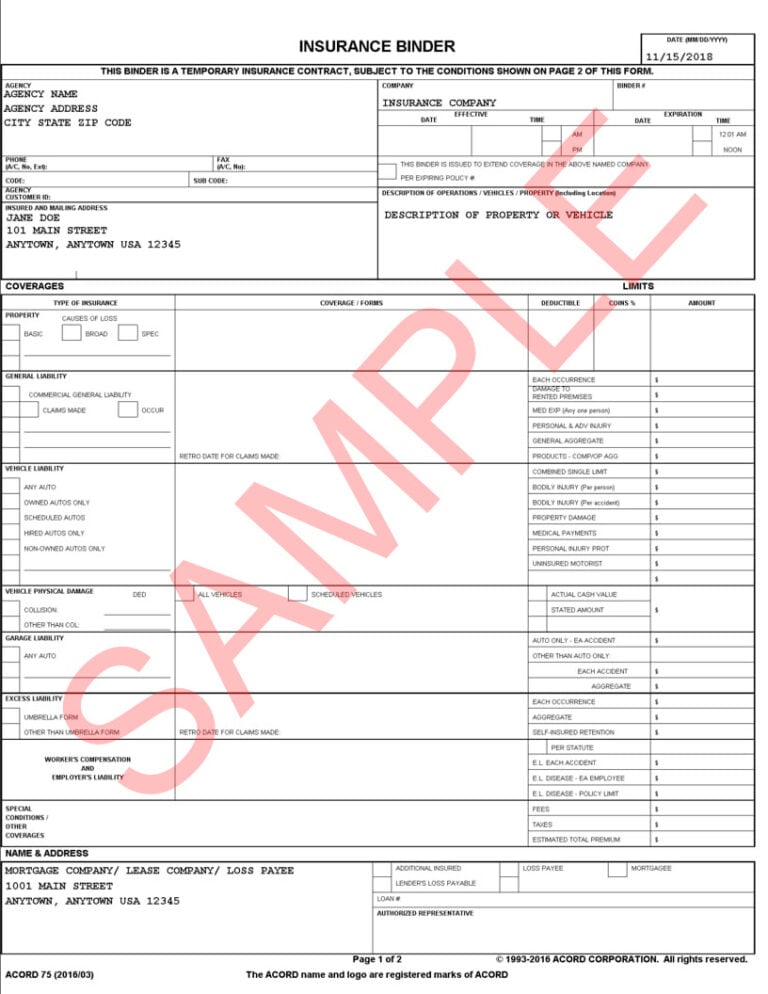

An insurance binder is a document that provides proof you have purchased insurance for a specific automobile or property location described in the binder. All necessary details about the policy including your insurance provider, coverage, deductible amount, and policy period. Typically, binders are issued for property or vehicles.

An insurance binder is needed when you need to prove you’ve purchased coverage before you have the policy summary. For instance, you may need proof of auto insurance when you’re in the process of purchasing a new car or proof of homeowner’s insurance to close a mortgage loan.

A car insurance binder may be a requirement of a car dealership, lease, or finance company when making a new vehicle purchase. The binder will provide a description of coverage, deductible amounts, and list the company requesting the information.

A home binder is most commonly requested during a new home purchase or refinancing an existing loan. The home insurance binder includes the property location, amount of coverage, and deductible. The binder will also list the name of the company requesting the information.

Your insurance binder is designed to provide temporary proof of insurance before the policy is finalized. An insurance binder is valid for a maximum of 30 days at which time it’s replaced by the policy summary or declarations page.

If you don’t already have home or auto insurance, you’ll likely need to purchase a policy to complete your loan. When you purchase the coverage you need, you can get an insurance binder to provide the details of your coverage to your lender.

Your insurance binder provides temporary proof of coverage. If you haven’t received your official policy information before the binder expires, it’s important to contact your provider.

TRUST LOPRIORE TO PROVIDE YOU WITH A MASSACHUSETTS INSURANCE BINDER

LoPriore Insurance Agency is a trusted local independent insurance agency ready to provide all customers with the insurance coverage and information they need quickly and efficiently. Whether you already work with one of our experienced agents or you need a dependable agent to help you obtain a new policy, we can quickly provide you with an insurance binder so your dreams don’t slip through your fingers. If you don’t have the insurance you need, contact us today to get the necessary coverage immediately.

Already a customer? Please fill out our simple form below to obtain your insurance binder. Don’t forget to fax or upload and attach any insurance requirement documents that you have received to ensure the proper handling and processing of your request. If you have any questions and/or require immediate assistance please don’t hesitate to call us after your request is completed.

Didn't Find WHat YOUR LOOKING FOR?

Click below for additional client service options or give us a call!