Homeowners Insurance

Start Comparing Your

Options Below

Massachusetts Home Insurance

Quote Options

In just a few minutes, you can compare quotes from several insurance companies

Instant Online Home Insurance Quote

For an online insurance quote, simply complete the form below. We will contact you to discuss coverage options and discounts.

Upload Your

Current Policy

Already have a policy? Easily upload your insurance policy so we can explore and compare true apple-to-apple options.

Talk To An

Agent

Need assistance or have questions? Our agents are happy to help. Please call to discuss your insurance needs.

In Massachusetts, homeowner’s insurance comes in varying coverage levels and protects your home and the possessions inside. Policies typically include protection in the event of a fire. Personal liability covers you from damages caused by you or others living in your home.

Massachusetts Homeowners Insurance Lopriore Insurance Agency

The LoPriore Insurance team understands that your home is more than just a place to live. It’s a sanctuary for you and your family and one of the most significant purchases you’ll ever make. Protecting your house and personal contents are very important. Thus, we make it our primary focus to partner with you to design the optimal policy. Then if the unthinkable occurs and your home sustains significant damage, you’ll be covered to quickly get back on your feet.

At LoPriore Insurance, We Make Insurance Easy For You. No two homes or families are alike, so we don’t offer one-size-fits-all home insurance plans. We partner with Local Domestic Insurance Companies, National, and regional insurance companies. This means we can find competitive solutions to fit your insurance needs and your pocketbook.

Homes We Insure

Single Family

Apartment

Condo

Town House

Vacation Home

Secondary Home

Multi Family

High-Value Home

Understanding the Importance of Homeowners Insurance

What is It?

Why Do I Need It?

Mortgage lenders require you to purchase homeowner’s insurance as part of your mortgage agreement. If you are able to buy a house outright with no mortgage, it’s not required. However, even when insurance isn’t mandated, you may decide to purchase a policy as a cost-effective way to avoid financial hardship in a disaster.

Who Is It For?

Anyone who owns a single-family home or multi-family residence can benefit from homeowners insurance. Indeed, affordable premiums will allow you to have the protection you need if damage occurs.

Homeowners Insurance HO-3 Policy

An HO-3 Home Insurance policy is designed to protect your home and property in the event of unexpected disasters. It’s the most common choice for Massachusetts homeowners. The HO-3 covers your home and additional surrounding structures. This means unattached buildings like sheds and garages are covered too.

Coverage Determined

Most HO-3 policies are based on replacement cost. This means reimbursement for a claim is based on the current cost of repairs and replacement instead of the cost you originally paid. Thus, you will work closely with an experienced agent to determine the amount of coverage needed to repair or replace your home.

What a Homeowners Insurance Policy Provides

Property Coverages

More About Personal Property Coverage

Personal property losses are generally settled on your possessions’ actual cash value at the time of your loss. However, you can choose a replacement cost option for your possessions as well. With replacement cost, you would be reimbursed for replaced items after your deductible is paid.

If you have items that aren’t sufficiently covered by your main homeowner’s policy, you can purchase additional policies. Pieces of high value Fine Art, antiques, and other rare items would qualify. Ask our experienced agents about a personal articles policy.

Here are some specific items and reimbursement amounts within the personal property coverage:

- Money and coin collections: $200

- Securities and stamps: $1,000

- Manuscripts: $1,000

- Theft of jewelry, watches, and fur: $1,000

- Watercraft: $1,000

- Trailers: $1,000

- Personal computer coverage: $2,500

- Theft of silverware and goldware: $2,500

- Trading cards, comic books, and memorabilia: $1,000

- Theft of cameras, tools, or firearms: $2,000

- Trees, shrubs, and plants: $500

Liability Coverages

What Optional Coverages Are Available?

Enhance Your Coverage with Optional Insurance Riders or Insurance Policies

There are a variety of options when deciding the coverage you need for your home. The policy you choose needs to be broad enough to cover the cost of repairing or replacing your home and possessions in the event of a loss or significant damage. Here are some things to consider.

Cost of Homeowner's Insurance in Massachusetts

It is recommended that you get multiple home insurance quotes to ensure you find the best policy. Home insurance costs vary significantly based on your coverage level, with prices ranging from $800 to $1,700 annually. The average cost in Massachusetts is about $1,320 per year. This makes Massachusetts the 38th most expensive state to insure a house. However, the price also varies depending on which city or town you live in.

Though there is a state average, the price naturally also varies based on the size of your house. Your home’s value is a crucial factor since your policy must have sufficient coverage to rebuild and restore your home.

Here’s a final interesting thing to think about with regards to policy average costs. Insurance prices go up when there are claims paid out. Massachusetts winters are often severely cold, and this is when homes are most vulnerable to damage.

Insurance

Cost of Insurance Breakdown by City

Avg Annual Cost $1,351

Avg Annual Cost $1,230

Avg Annual Cost $1,725

Avg Annual Cost $1,290

Avg Annual Cost $1,120

Avg Annual Cost $1,120

Avg Annual Cost $1,143

Avg Annual Cost $1,100

Avg Annual Cost $1,351

Avg Annual Cost $1,230

Avg Annual Cost $1,725

Avg Annual Cost $1,290

Avg Annual Cost $1,120

Avg Annual Cost $1,120

Avg Annual Cost $1,143

Avg Annual Cost $1,100

Knowing the average cost per city may help you decide where to live if you are particular about insurance rates. Though it should not be the sole factor in determining where you should reside, it’s good to be aware of.

Homeowners insurance may be an added expense on your part, but it will certainly be helpful in the long run. We recommend researching your options thoroughly. LoPriore Insurance Agency can help you find the most affordable and best homeowners insurance policy in Massachusetts.

Cost of Insurance Breakdown by City

Avg Annual Cost $1,986

Avg Annual Cost $1,100

Avg Annual Cost $1,290

Avg Annual Cost $1,725

Knowing the average cost per city may help you decide where to live if you are particular about insurance rates. Though it should not be the sole factor in determining where you should reside, it’s good to be aware of.

Homeowners insurance may be an added expense on your part, but it will certainly be helpful in the long run. We recommend researching your options thoroughly. LoPriore Insurance Agency can help you find the most affordable and best homeowners insurance policy in Massachusetts.

Looking To Save More

Bundle Your

Home and Auto

Looking To Save More Bundle Your Home and Auto

Looking to save more on your insurance costs? Bundle your home and auto insurance today and discover the great discounts and benefits that come with combined coverage. Act now and start saving!

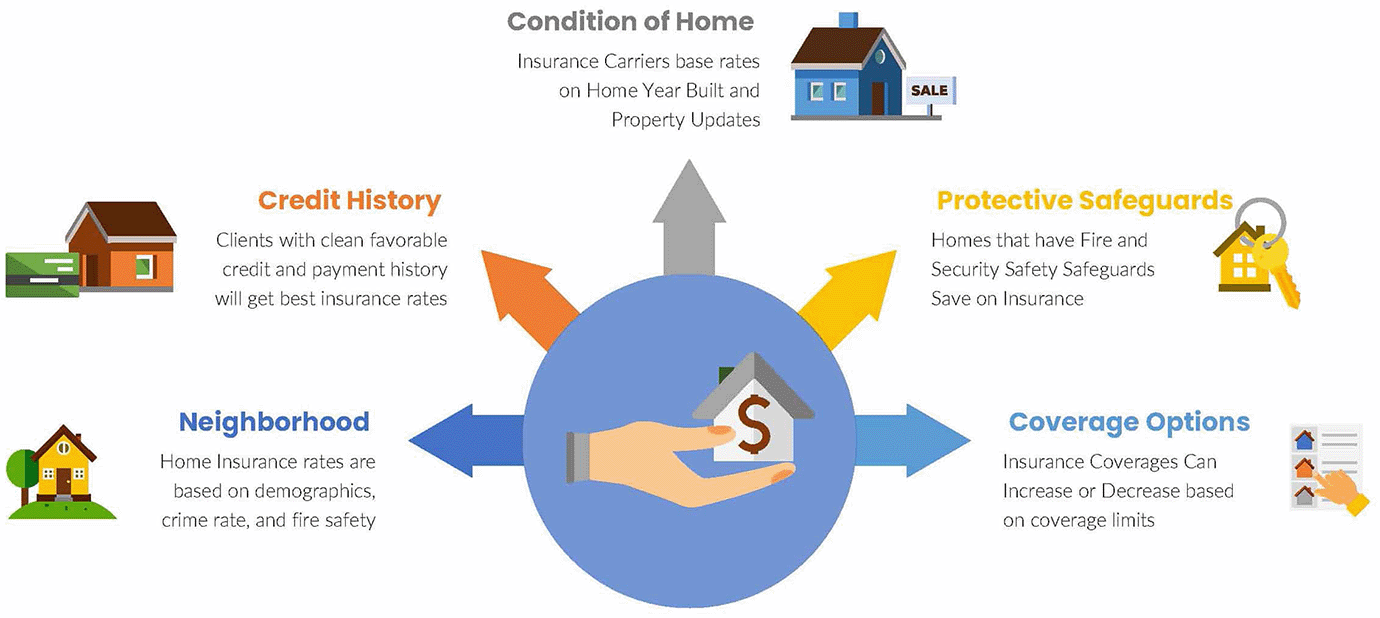

Rating Factors Affecting Home Insurance Rates and Premiums

Already Have Insurance Upload Your Policy

Switching Your Insurance Made Easy!

Upload Your Current Insurance Policy to Compare & Save!

What’s The Advantage of Comparing My Insurance Policy?

When you send us a copy of your policy, our team has an opportunity to get a snapshot of your current insurance coverage, discounts, and added riders on your existing insurance policy.

Where Do I Find a Copy of My Insurance Policy?

Insurance companies send you a copy of your insurance policy annually and if any changes to your policy have been made during the year. However, if you are unable to locate your policy, your insurance company or insurance agent should be able to send you a duplicate copy via email, fax, or mail.

What Happens When You Upload Your Policy?

Once we receive your uploaded policy one of our team members begins reviewing your policy. We will then contact you to discuss your coverage options. Every insurance company has different underwriting guidelines and offers different coverages and rates. Be advised while we try our best to quote with the information provided it still may be necessary to obtain additional information from you to prepare the most accurate rate.

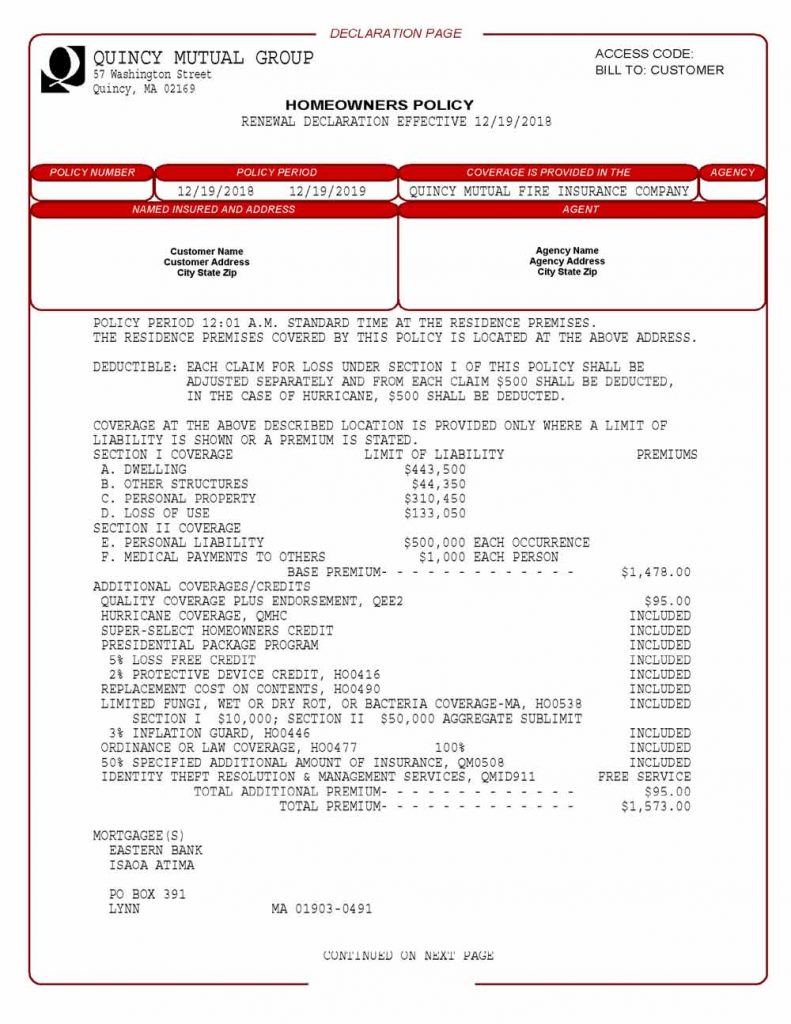

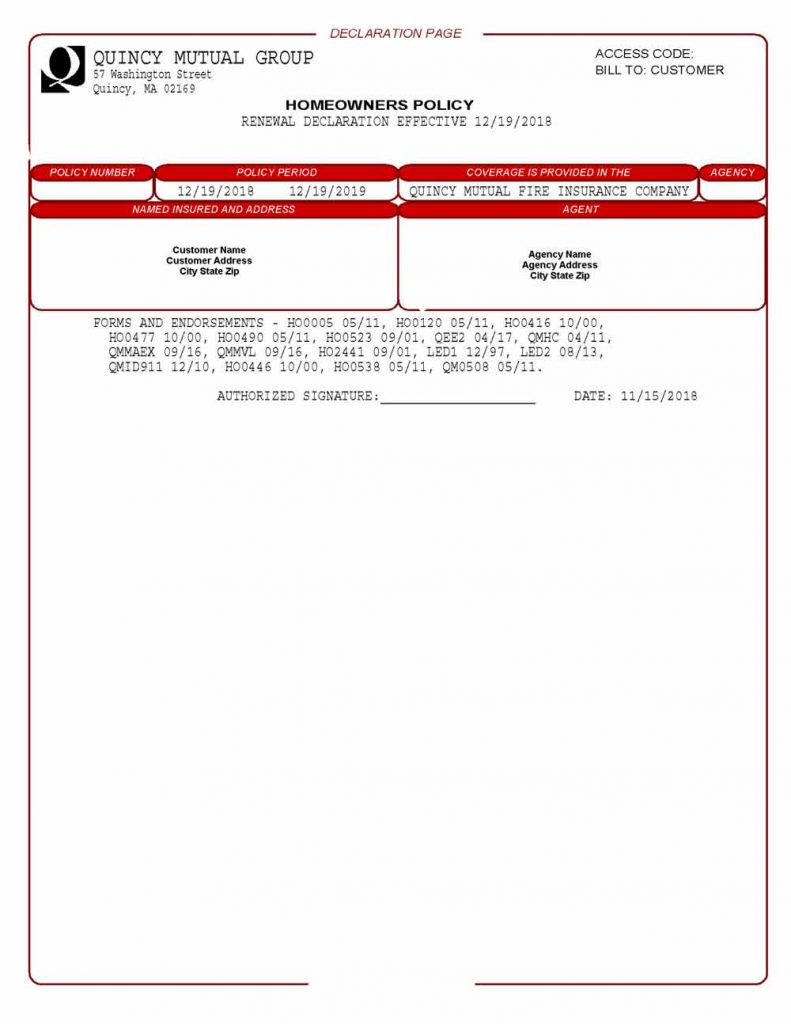

What Does My Insurance Policy Coverage Page Look Like?

Insurance Policies will sometimes be referred to as a Coverage Selections Page or Coverage Declarations Page. Below are samples of the different types of insurance policies (click to see larger view)

Homeowners Insurance FAQ

Insurance agents use a replacement cost estimator to determine the value to insure your home based on the information and characteristics you provide about the property to adequately protect your home.

Higher deductibles usually are available to help you save money. At LoPriore Insurance Agency, we also offer a variety of special discounts to help lower your rates. Check if you qualify for any of these discounts.

- New home – A discount is available for more modern homes.

- Mature homeowners – A discount for policyholders who are 55 years of age or older and retired. For married couples, one spouse must be at least 55.

- Multi-policy discount – Available if you have both homeowners and automobile insurance with us.

- Protective Devices – Available for an automatic sprinkler system, a central fire alarm system, a central burglar alarm system, and a combination of smoke detectors (one per living level), deadbolt locks (on all exterior doors), and fire extinguisher(s).

- Claim free discount – Available only to those who have been our customers for several years.

- Non–smoker discount

- Renewal credit

A home insurance binder provides proof of insurance coverage related to the property insured which clearly states coverages and includes any loss payees or additional interests if there are any.

Yes, if your lender has set up an escrow account to pay your insurance premium, we can bill mortgagee or lender directly. This option is a widespread practice lenders use to pay your home insurance and even your property taxes.

Renting your home can sound like a financial windfall, although your homeowner’s insurance policy may not include coverage for home-sharing. Before you rent your property on a short term basis, contact your independent insurance agent to discuss options that add the additional coverage needed to protect your property against damage and personal liability claims.

Ready to Get Started?

Get Top Rated Insurance Coverage at the Best Price!

CALL US TODAY